Tag Archives: Tsx.V

Tartisan Nickel Corp. – TN:CSE = Moving Towards Production in Kenora

Tartisan Nickel is on a path to mineral production at Kenbridge in Kenora! This is their 100% owned Kenbridge Nickel Deposit located in Kenora Ontario.

Kenora is a prolific mineral district. Kenbridge was originally discovered in 1937 and was actually mined by Falconbridge in the mid 1950’s for 2.5 years which makes the deposit a logical candidate to go back into production- plus undergo expansion using modern mineral discovery techniques. It is in a mining friendly jurisdiction with all season road access within 9km.

An additional positive note for Tartisan Nickel is they are planning to produce electric vehicle (EV) battery metals.

With so many climate issues the world definitely needs the nickel copper and cobalt metals which this deposit holds!

DETAILS OF THE KENBRIDGE DEPOSIT: Website Link

Ownership: 100%

Commodities: Nickel, Copper, Cobalt

Location: NW Ontario

Status: Advanced Nickel Deposit

Next Steps: Surface exploration and definition drilling plan, in addition to geotechnical, metallurgical and environmental work

Kenbridge Nickel Resource Updated Estimates

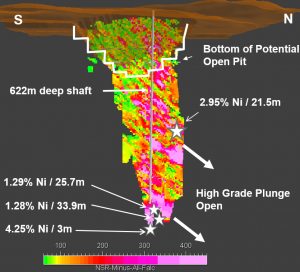

Tartisan Nickel published (Sedar: September 17, 2020) a NI 43-101 updated resource estimate that outlined a combined open-pit and underground, historic measured and indicated resource of 7.58 Mt at 0.58% nickel, 0.32% copper for a total of 95 million pounds of contained nickel.

There are more mineral resources to be discovered at Kenbridge undoubtably, and with nickel currently trading over $11.00 U.S. that means there is over $1 Billion of nickel currently ready to be mined at Kenbridge. With certainty and a lot of upside with what is basically already defined exploration targets Tartisan Nickel can deliver a known already mined resource with modern techniques to deliver what could be substantial upside. THis makes for a very exciting story moving ahead.

ENVIRONMENTAL

As of May 31, 2022 Tartisan Nickel Corp. has commenced environmental baseline studies at the Kenbridge nickel project in the Kenora mining district in Northwestern Ontario. Their “P.E.A” is now in the wrap up phase and the Company hopes to update shareholders next month.

Mining production success is the whole point and ultimate aim of exploration.

Therefore we feel it is important to be aware of companies which have achieved the ability to be in that position in the near future. It takes a lot of work and perseverance to achieve this goal but ultimately adds the most value.

-We will be keeping you updated,

Canadian Junior Report

PDAC 2022 is live!

Lots of action happening this year with hundreds of exploration companies set up on the exhibition side and the PDAC trade show section full of the usual service providers.

Expecting attendance to pick up tomorrow on the floor. There are many juniors in a great position to gain market cap value it would appear since the whole sector in general has been sliding for months and months it seems.

What they call ‘the fluff’ has really been gone from the sector for a long time because of the extended bear market in junior mineral exploration in general, with juniors such as Scottie Resources Corp. (SCOT-TSXV trading at .18 cents) displaying some really impressive drill results at their Golden Triangle properties. Results are showing very good consistency and talking to their CEO gives one a sense that he is going to get the job done properly.

More to come from PDAC 2022…

PDAC 2022 ‘Prospectors & Developers Association of Canada’ 90th Year

Exciting News: The PDAC is back in person in 2022, for its 90th birthday!

The date of the show will now be held from June 13-15 in person and June 28-29 online.

This is a change from the usual spot in early March, probably due to ongoing pandemic considerations.

After 2 years of being hosted online only due to the Covid pandemic it appears 2022 will see the world renowned Prospectors and Developers Association of Canada back in all it’s glory.

Also looks like this years event will be busy as we see this announcement on the official website:

“Please note that exhibit space for the in person portion of the Trade Show is sold out. See below for more details.” Prior years regularly have seen well over 30,000 attendees so we expect the event to be very busy this year given that the pandemic measures continue to normalize.

You can register by clicking this link: PDAC 2022 Registration

-The location for exhibits and trade show events at the Metro Toronto Convention Centre in downtown Toronto at 222 Bremner Boulevard, Toronto Canada.

As usual we expect to see various company parties and evening events hosted at other venues in the surrounding downtown area as in pre covid years. There is usually a list of events posted in the lobby of the Royal York Hotel and

flyers posted and so on in the convention area and at the exhibit booths.

2022 promises to be a very exciting year as there has been a lot of important discoveries and the term ‘commodities supercycle’ has become popular lately, as well as the need for certain metals to support national defense and various industries that rely on a secure supply of metals for their products. This has lent a more than usual sense of urgency to the important task of finding new mineral resources.

Hope to see you there!

Editor,

The Canadian Junior Report

PDAC Contact Address:

–Prospectors & Developers

Association of Canada

800-170 University Avenue

Toronto, Ontario M5H 3B3

416 362 1969

info@pdac.ca convention@pdac.ca

Global Lithium demand continues to Dazzle

LITHIUM! The new oil?

One of the biggest commodity stories of 2021 is the enormous demand for lithium to supply batteries for electric vehicles. Electric vehicle production has grown at a staggering pace for anyone aware that not that long ago all the electric cars made were taken out into the desert and destroyed! Now I wonder who was behind those shenanigans?

At any rate we have a new consciousness which declares that electric vehicles are going to save the planet from overheating and we need them to replace ICE vehicles as soon as yesterday.

For this to occur we need batteries and lots of them! Those batteries take lithium to construct, hence the lithium price has soared to all time highs of approximately $30,000.00/ton U.S. as companies and countries move aggressively to obtain reliable supplies.

Further, according to data from the website MarketsandMarkets.com, (Article Link)the demand by 2025 will increase by more than double:

The lithium compounds market is projected to grow from USD 5.3 billion in 2020 to USD 13.5 billion by 2025, at a CAGR of 20.6% from 2020 to 2025.

A junior exploration company which we own shares in largely because of faith in management is Infinite Ore Corp. (ILI.V OTCQB-ARXRF)

Jackpot Lithium deposit is the name of their established lithium deposit near Thunder Bay Ontario which is high grade although is rather small at present and needs to be expanded by more exploration. Jackpot is approximately 2 million tones of over 1% lithium which is considered high grade.

ILI has very recently closed a financing for approximately $8 million (cad) to expand their lithium holdings although it is unclear at this point where they will focus their spending.

We await further guidance from management, and the prospect has not gone unnoticed as the company valuation has basically doubled recently on the news of financing. The financing was done around 100% below where the share price was trading so that tells you something positive is happening in the sector and the company as well/

Stay tuned for updates and “GO Lithium!”

Disclosure: Editor owns shares of Infinite Ore Corp. and may buy or sell at any time. Infinite Ore Corp. is

-

not

a paid client.